Most papers are available

through an external site.

(Links will open in a new window.)

"Profitability,

Investment, and Average Returns"

Revised: June 2005 / First Draft: September 2001

Valuation theory says that expected stock returns are related to three variables: the book-to-market equity ratio (Bt/Mt), expected profitability, and expected investment. Given Bt/Mt and expected profitability, higher rates of investment imply lower expected returns. But controlling for the other two variables, more profitable firms have higher expected returns, as do firms with higher Bt/Mt. These predictions are confirmed in our tests. Our results are qualitatively similar to earlier evidence, but in quantitative (economic) terms, there are some interesting surprises.

"The Anatomy

of Value and Growth Stock Returns"

Revised: June 2005 / First Draft: August 2004

We break average returns on value and growth portfolios into dividends and three sources of capital gain, (i) reinvestment of earnings, (ii) convergence in price-to-book ratios (P/B) due to mean reversion in profitability, growth, and expected returns, and (iii) general upward drift in P/B during the 1963-2004 period. The contribution of drift to average returns is similar for value and growth portfolios, and relatively small. Dividends are important for value stocks, but reinvestment of earnings is a trivial factor in their capital gains. The high capital gains of value stocks trace mostly to convergence – P/B rises as value firms become more profitable and move to lower expected return groups. In contrast, dividends are less important for growth stocks, and reinvestment is the dominant positive factor in their capital gains. For growth stocks, convergence is negative – P/B falls because growth stocks do not always remain highly profitable with low expected returns.

"The Value

Premium and the CAPM"

Revised: May 2005 / First Draft: November 2004

We examine (i) how value premiums vary with firm size, (ii) whether the CAPM explains value premiums, and (iii) whether in general average returns compensate beta in the way predicted by the CAPM. Loughran’s (1997) evidence for a weak value premium among large firms is special to 1963-1995, U.S. stocks, and the book-to-market value-growth indicator. Ang and Chen’s (2005) evidence that the CAPM can explain U.S. value premiums is special to 1926-1963. The CAPM’s general problem is that variation in beta unrelated to size and value-growth goes unrewarded throughout 1926-2004. This produces rejections of the model for 1926-1963 and 1963-2004.

"Disagreement,

Tastes, and Asset Prices"

Revised: March 2005 / First Draft: September 2003

Standard asset pricing models assume that (i) there is complete agreement among investors about probability distributions of future payoffs on assets, and (ii) investors choose asset holdings based solely on anticipated payoffs; that is, investment assets are not also consumption goods. Both assumptions are probably unrealistic. We provide a simple framework for studying how disagreement and tastes for assets as consumption goods can affect asset prices.

"Newly

Listed Firms: Fundamentals, Survival Rates, and Returns"

Revised: July 2001 / First Draft: May 2001

After 1979, the rate at which new firms are listed on the major U.S. stock exchanges increases sharply, asset growth rates of new lists are high, but their profitability declines and remains low for at least five years after listing. New lists also become less likely to survive, primarily because of delisting for poor performance. Overall, market prices reflect the volatile dynamics of new list fundamentals. Thus, for the full 1926 to 2000 period and the 1973 to 2000 Nasdaq period, value-weight and equal-weight new list returns are close to benchmark returns. For the high action 1980 to 2000 period, equal-weight new list returns are low, but value-weight returns are again close to benchmark returns.

"Testing

Tradeoff and Pecking Order Predictions about Dividends and Debt"

Revised: December

2000 / First Draft: August 1999

Confirming predictions shared by the tradeoff and pecking order models, more profitable firms and firms with fewer investments have higher dividend payouts. Confirming the pecking order model but contradicting the tradeoff model, more profitable firms are less levered. Firms with more investments have less market leverage, which is consistent with the tradeoff model and a complex pecking order model. Firms with more investments have lower long-term dividend payouts, but dividends do not vary to accommodate short-term variation in investment. As the pecking order model predicts, short-term variation in investment and earnings is mostly absorbed by debt.

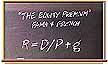

"The

Equity Premium"

Revised: July 2000 / First Draft: May 2000

We compare estimates of the equity premium for 1872-1999 from realized

returns and the Gordon (1962) constant dividend growth model. The

two approaches produce similar equity premium estimates for 1872-1949,

about 4.5 percent per year. For 1950-1999, however, the estimates

from the Gordon model, about 3.5 percent per year, are less than half

the estimates from realized returns. We argue that the high realized

returns for 1950-1999 are the result of (i) shocks to long-term profitability

and dividend growth rates that are on balance positive during this

period, and (ii) unexpected declines in long-term discount rates,

most likely as a result of the sustained decline in the volatility

of earnings, dividends, and returns. The Gordon model's estimates

of the equity premium for 1950-1999 are more accurate because they

are less sensitive to such surprises.

"Disappearing

Dividends: Changing Firm Characteristics or Lower Propensity to Pay?"

Revised: March 1999 / First

Draft: July 1998

The percent of firms paying cash dividends falls from 66.5 in 1978 to 20.7 in

1998. The decline is due in part to the changing characteristics of publicly traded

firms. Fed by new lists, the population of publicly traded firms tilts increasingly

toward small firms with low profitability and strong growth opportunities - characteristics

typical of firms that have never paid dividends. More interesting, we also show

that controlling for characteristics, firms become less likely to pay dividends.

This lower propensity to pay is at least as important as changing characteristics

in the declining incidence of dividend payers.