|

|

Description

of Fama/French Benchmark Portfolios

The Fama/French benchmark portfolios are rebalanced quarterly using

two independent sorts, on size (market equity, ME) and book-to-market

(the ratio of book equity to market equity, BE/ME). The size breakpoint

(which determines the buy range for the Small and Big portfolios) is

the median NYSE market equity. The BE/ME breakpoints (which determine

the buy range for the Growth, Neutral, and Value portfolios) are the

30th and 70th NYSE percentiles. (See the description of

each portfolio.)

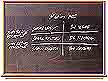

Buy Ranges for Benchmark Portfolios

|